Intel (NASDAQ:INTC) Looks Attractive for Investors that can Wait-Out the Growth Campaign - Simply Wall St News

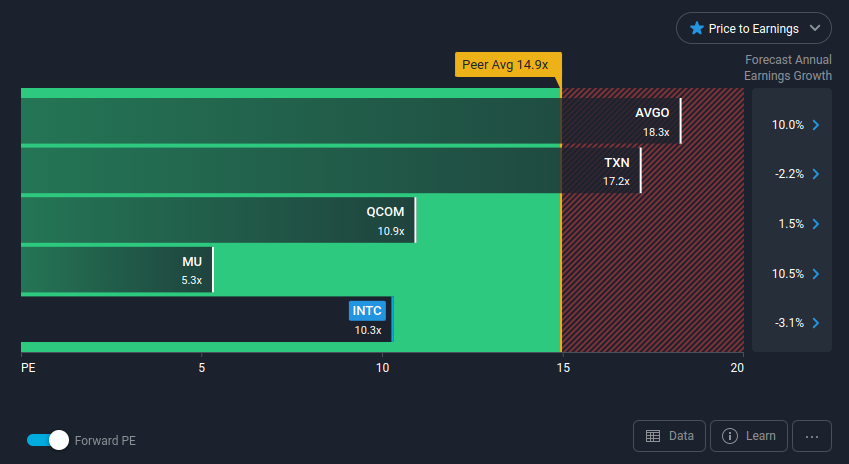

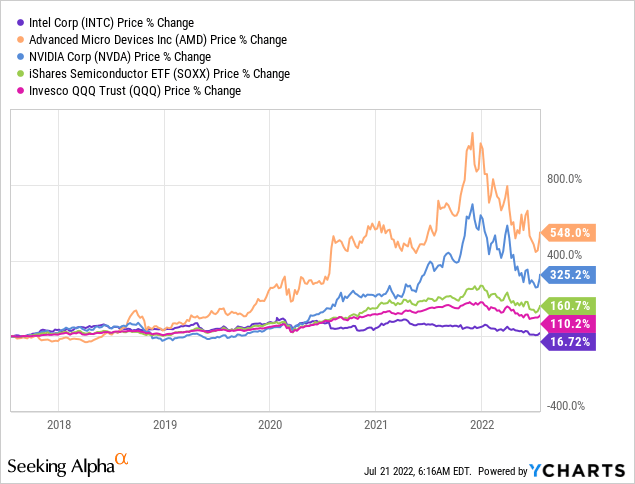

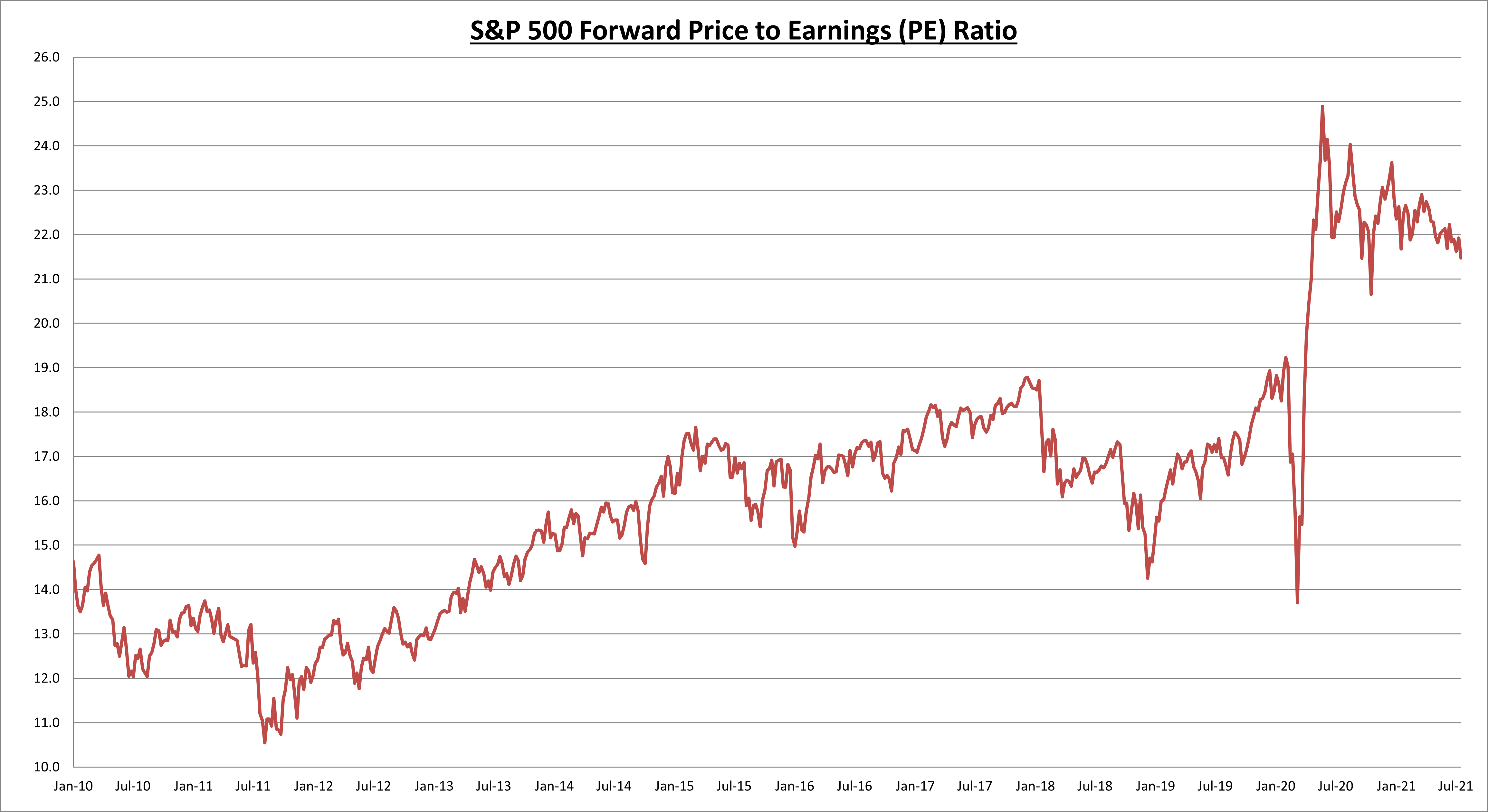

Why I think INTC (Intel) stock is undervalued. The Per Share Price (% Stock Price), when added up, equals to $65. INTC is currently $54. The P/E ratio is only 12.10, and

Intel (NASDAQ:INTC) Looks Attractive for Investors that can Wait-Out the Growth Campaign - Simply Wall St News

Why I think INTC (Intel) stock is undervalued. The Per Share Price (% Stock Price), when added up, equals to $65. INTC is currently $54. The P/E ratio is only 12.10, and

:max_bytes(150000):strip_icc()/generate_fund_chart1-5c801f0f46e0fb0001d83e40.png)

:max_bytes(150000):strip_icc()/generate_fund_chart-5c801ee6c9e77c0001e98f77.png)