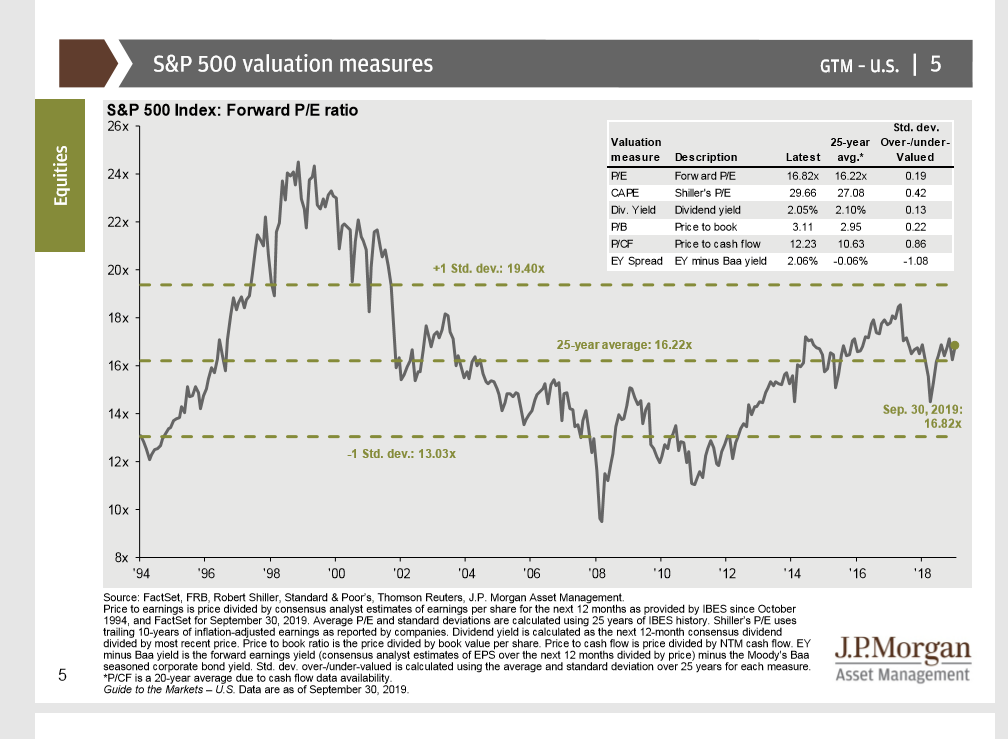

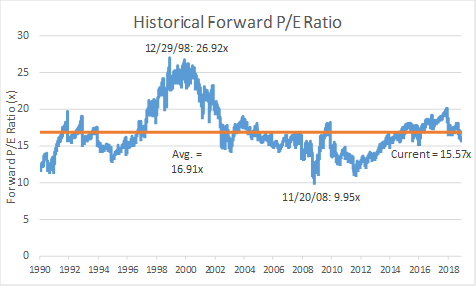

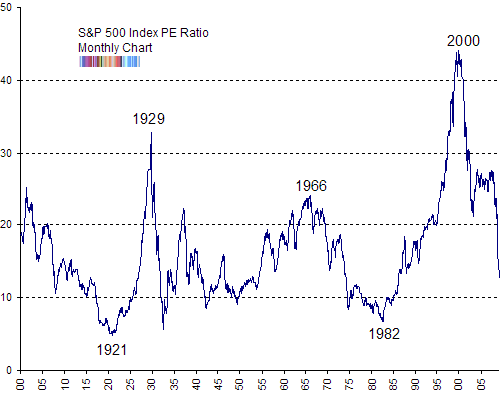

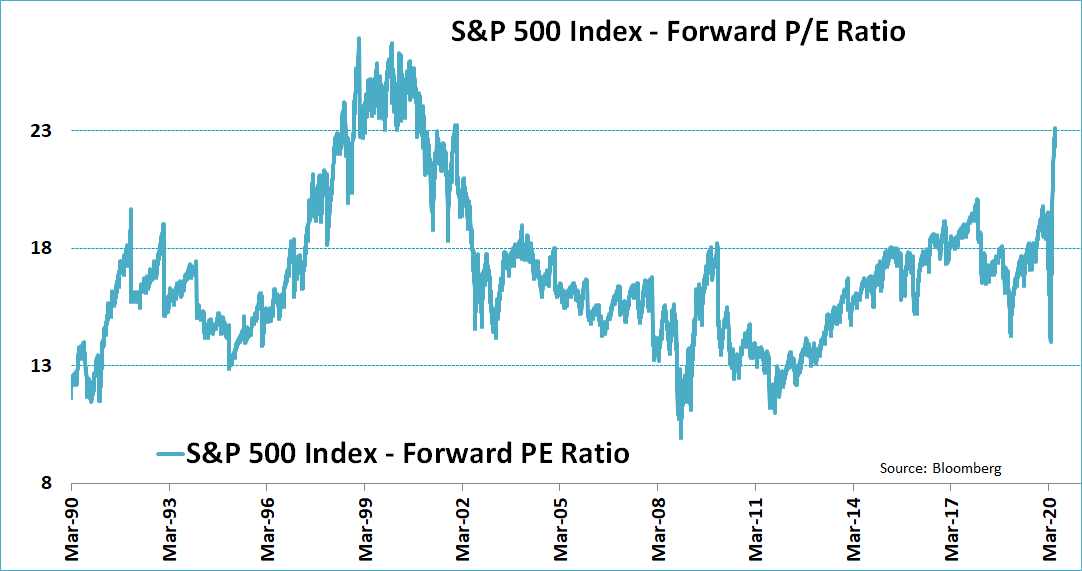

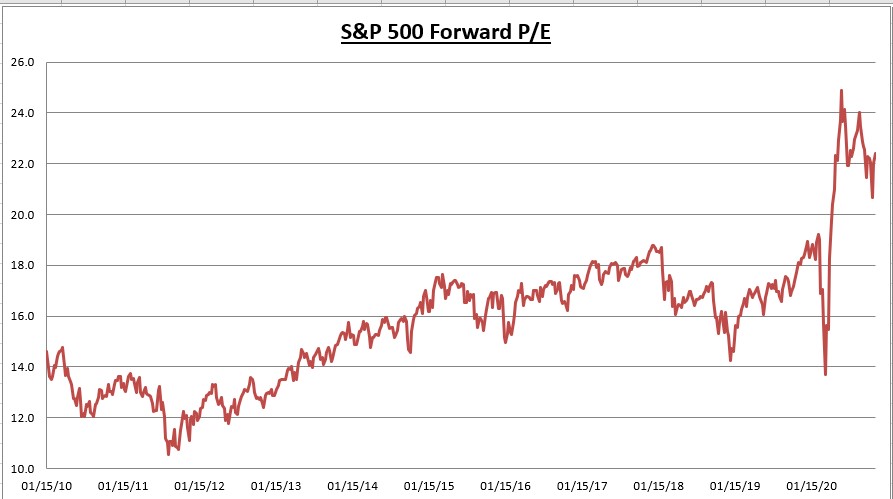

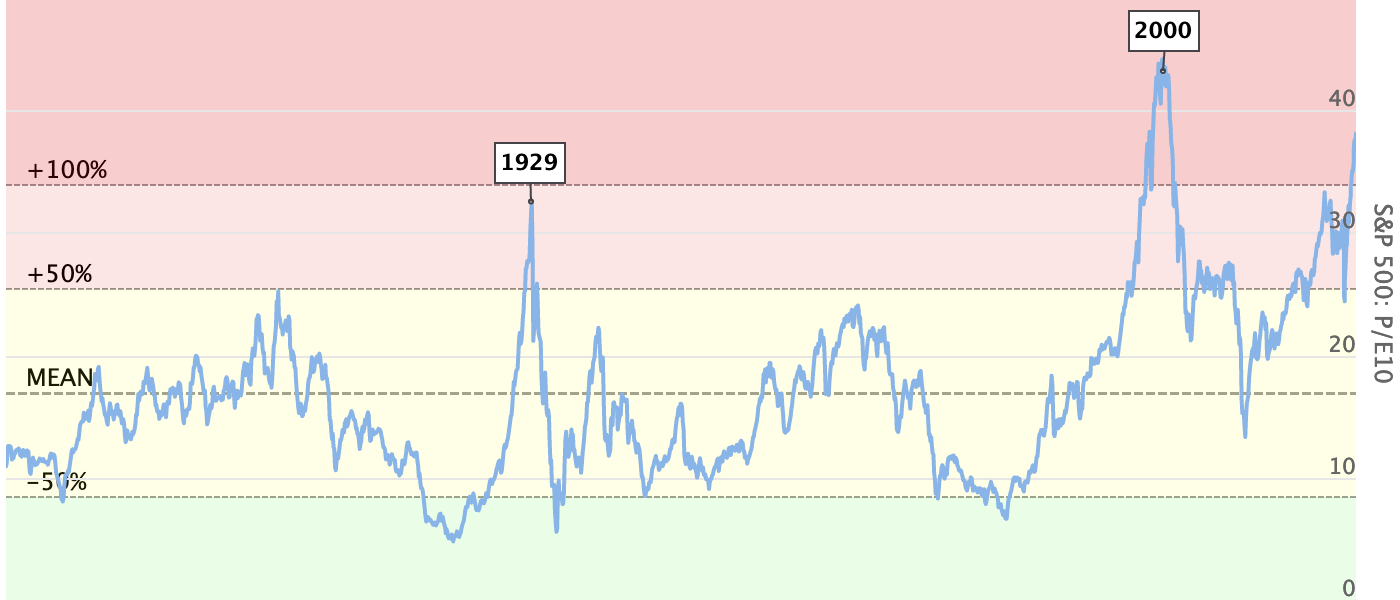

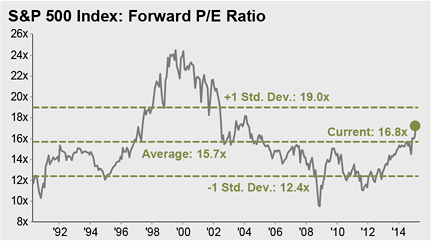

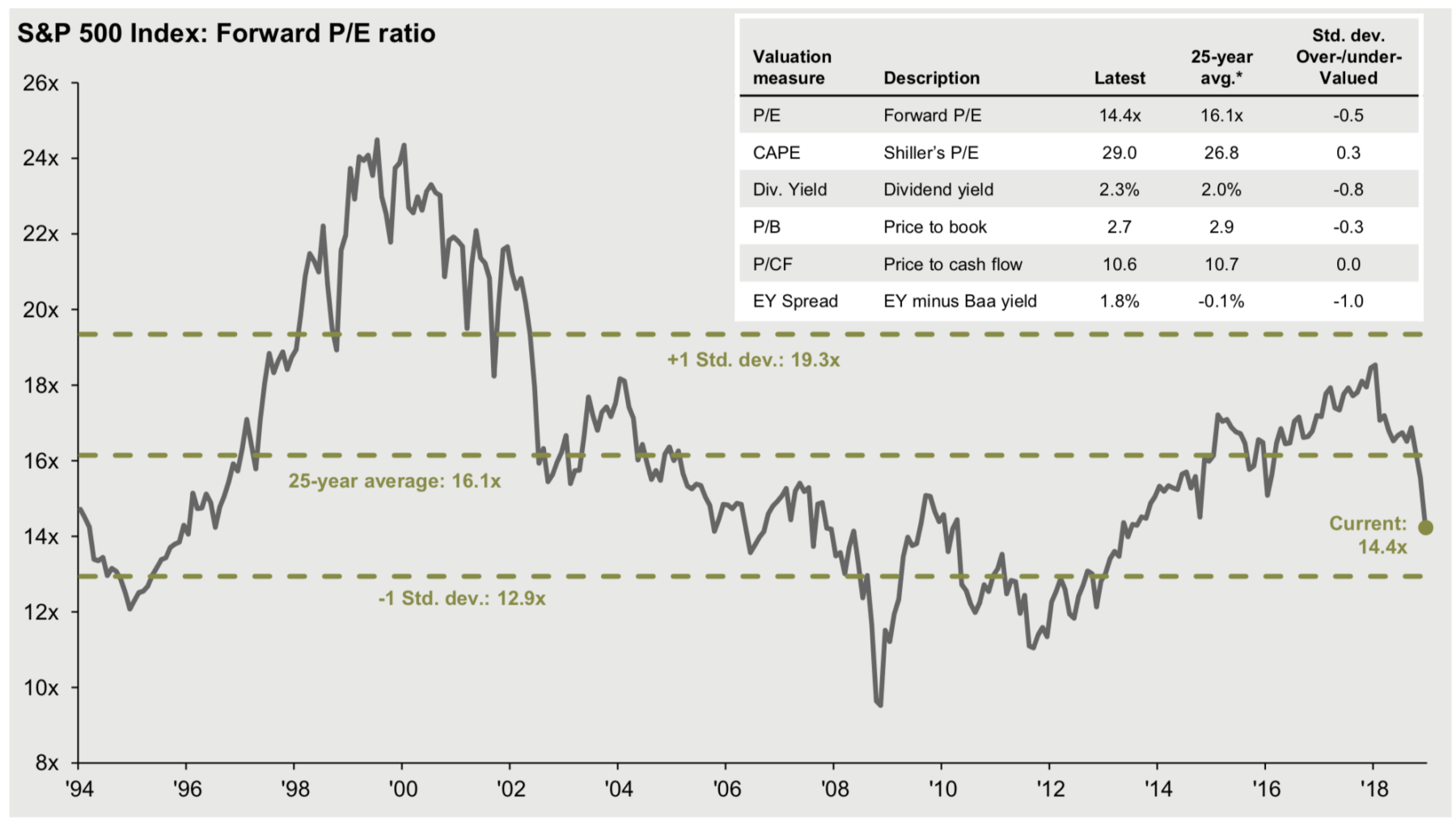

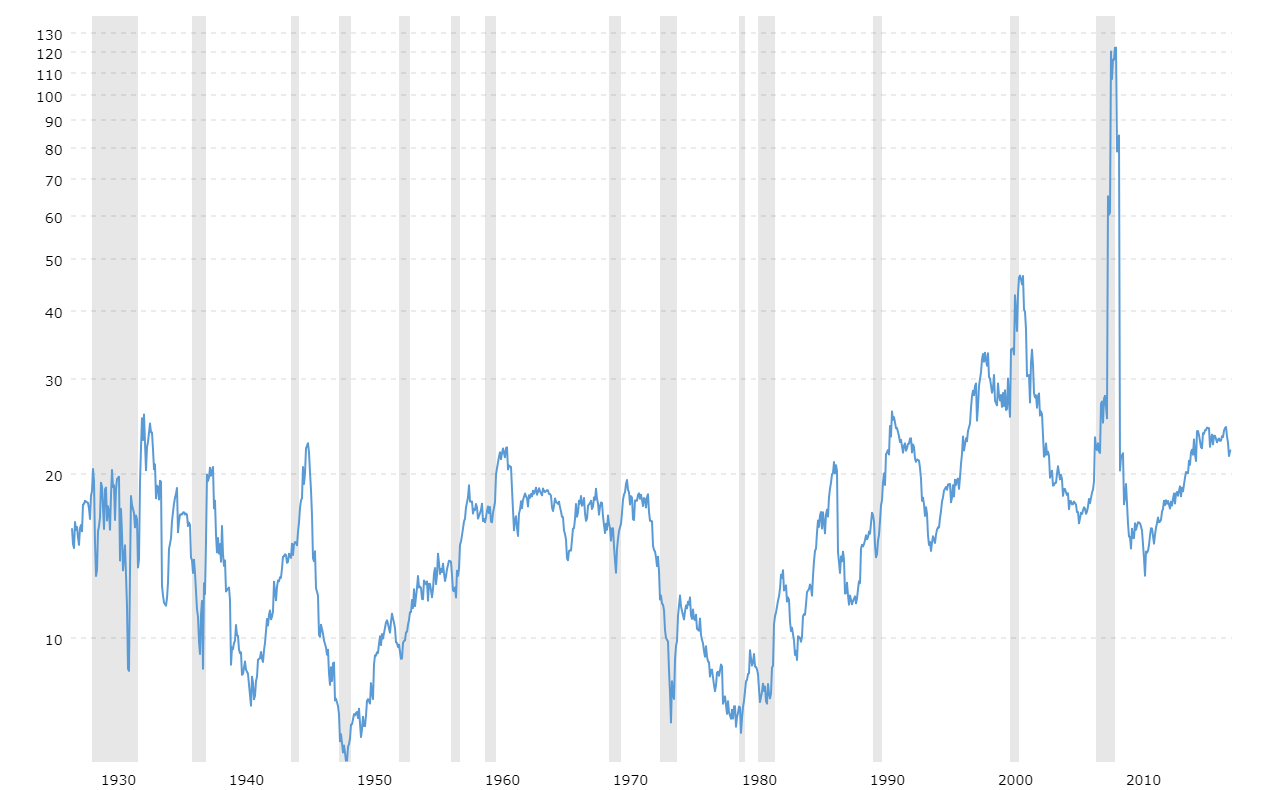

Holger Zschaepitz on Twitter: "Just to put things into perspective. US stocks very expensive after the recent rally. S&P 500 12 month forward multiple now at 22, S&P 500 24 month multiple

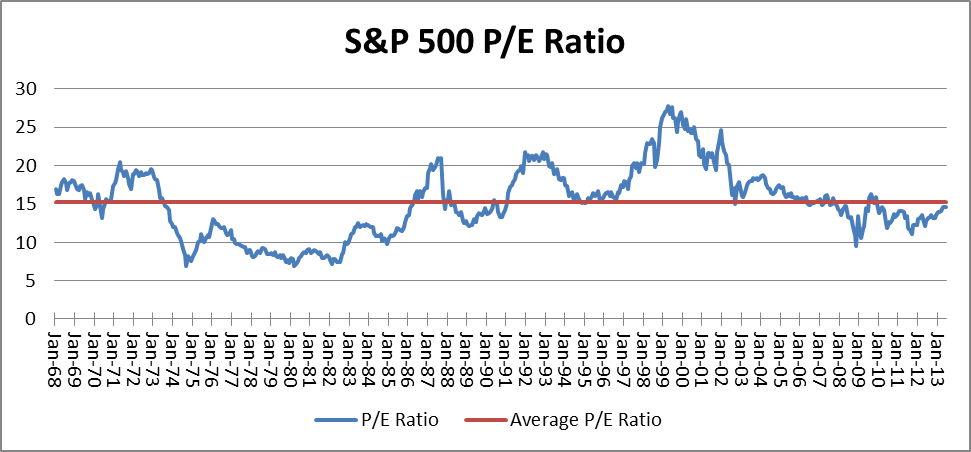

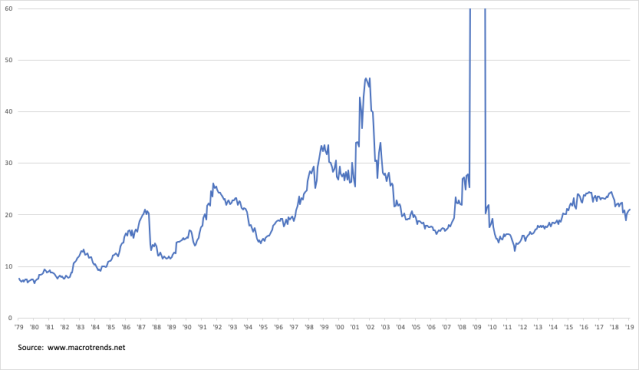

S&P 500 valuations historically high even after drop from 2020 peak | S&P Global Market Intelligence

Insight/2020/02.2020/02.21.2020_EI/S%26P%20500%20Forward%2012%20month%20PE%20ratio.png)

Insight/2022/05.2022/05.16.2022_TOW/sp-500-forward-12-month-pe-ratio-10-years.png?width=672&name=sp-500-forward-12-month-pe-ratio-10-years.png)

Insight/2022/05.2022/05.16.2022_TOW/sp-500-change-forward-12-month-eps-vs-change-price-10-years.png?width=672&name=sp-500-change-forward-12-month-eps-vs-change-price-10-years.png)

Insight/2020/02.2020/02.21.2020_EI/S%26P%20500%20Sector%20Level%20Forward%2012%20month%20PE%20ratios.png)

Insight/2022/02.2022/02.25.2022_EI/sp-500-change-forward-12m-eps-vs-price-five-years.png)

Insight/2022/02.2022/02.25.2022_EI/sp-500-forward-12-month-pe-ratio-five-years.png)