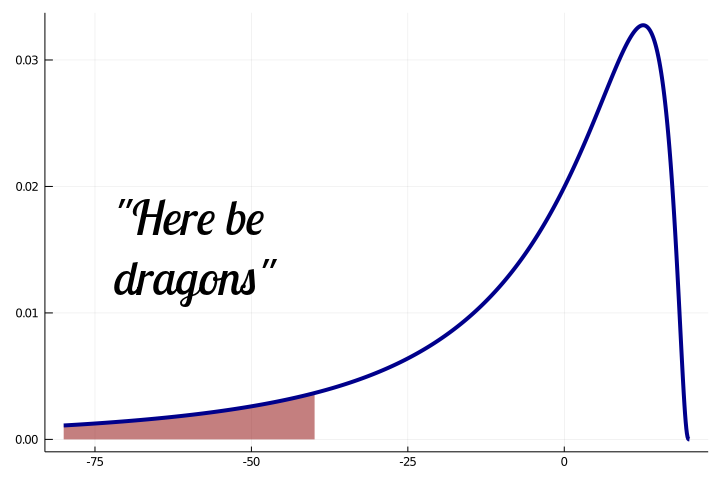

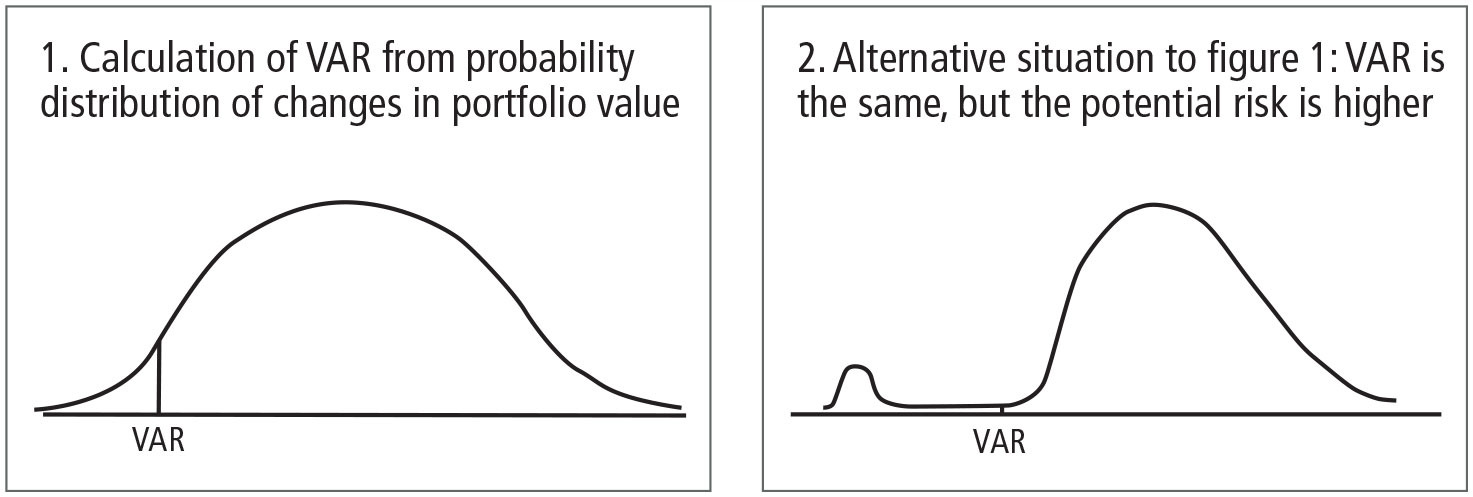

![PDF] VALUE AT RISK AND EXPECTED SHORTFALL: A COMPARATIVE ANALYSIS OF PERFORMANCE IN NORMAL AND CRISIS MARKETS | Semantic Scholar PDF] VALUE AT RISK AND EXPECTED SHORTFALL: A COMPARATIVE ANALYSIS OF PERFORMANCE IN NORMAL AND CRISIS MARKETS | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/22d5569b13dc44c199daa160639d36d424a543f6/16-Figure3-1-1.png)

PDF] VALUE AT RISK AND EXPECTED SHORTFALL: A COMPARATIVE ANALYSIS OF PERFORMANCE IN NORMAL AND CRISIS MARKETS | Semantic Scholar

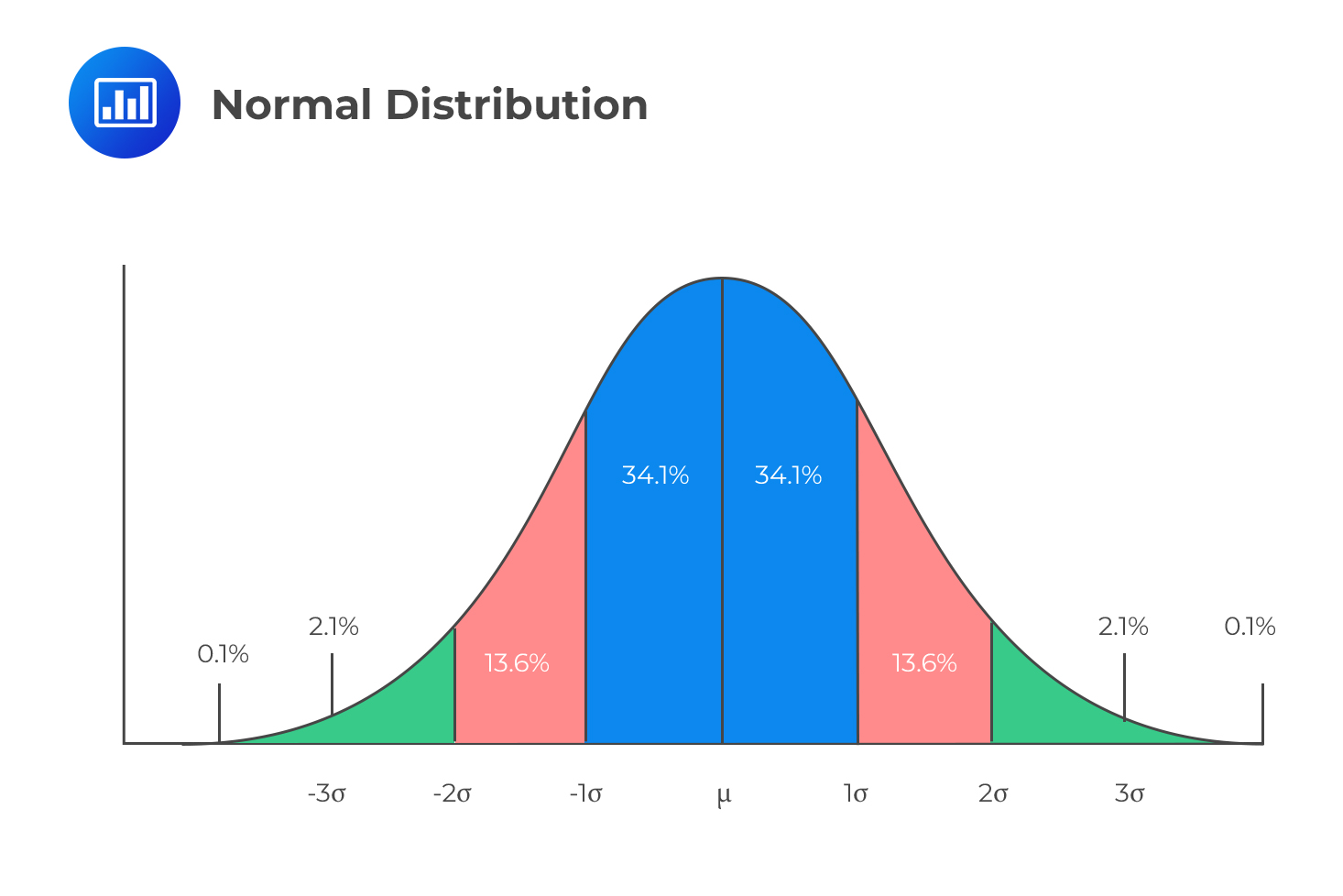

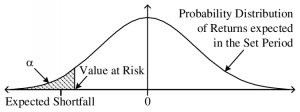

Risks | Free Full-Text | Good-Deal Bounds for Option Prices under Value-at-Risk and Expected Shortfall Constraints

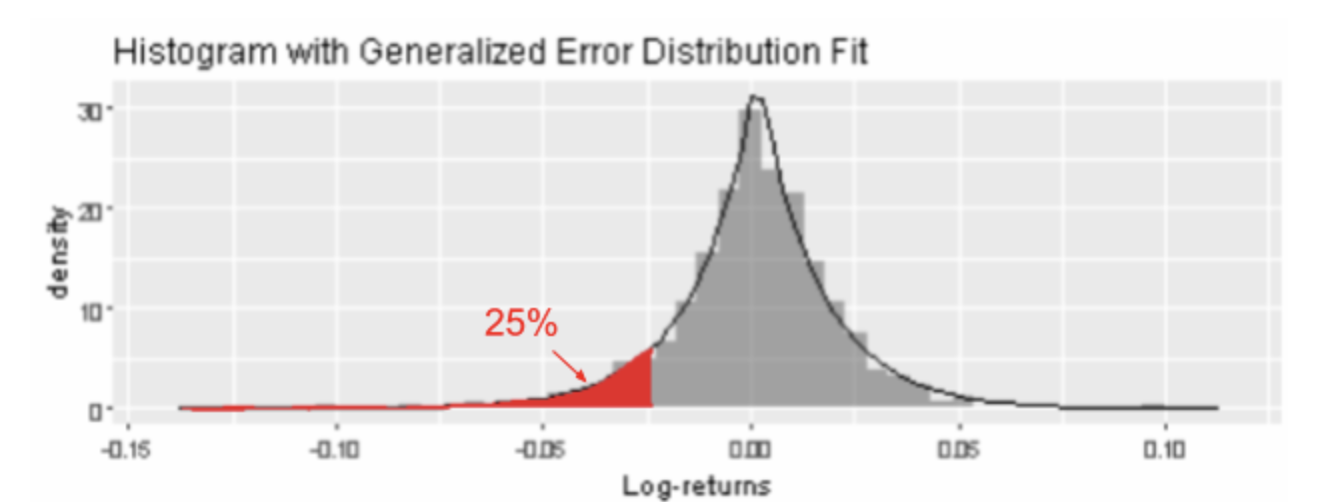

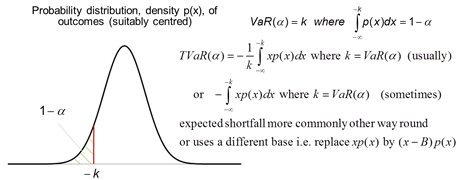

Figure 2 from On the Validity of Value-at-Risk: Comparative Analyses with Expected Shortfall | Semantic Scholar

![PDF] On the Validity of Value-at-Risk: Comparative Analyses with Expected Shortfall | Semantic Scholar PDF] On the Validity of Value-at-Risk: Comparative Analyses with Expected Shortfall | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/23106fd15c5db819de39ca2fc5dd943b1c4cff6e/7-Figure1-1.png)

PDF] On the Validity of Value-at-Risk: Comparative Analyses with Expected Shortfall | Semantic Scholar